Categories

We build bridges for free

for the crypto community

Please support us!

Crypto Market Surges with $3.3 Billion in Inflows as Bitcoin Nears $110,000

by admin on | 2025-05-27 11:00:31

Share: Facebook | Twitter | Whatsapp | Visits: 542

The cryptocurrency market has experienced a significant upswing, with digital asset investment products attracting $3.3 billion in inflows last week, marking six consecutive weeks of gains. The total market capitalization rose by 0.3% to $3.58 trillion, driven by renewed institutional and retail interest. Bitcoin (BTC) led the charge, reaching an intraday high of $110,228 and trading at approximately $109,654, while altcoins like Ethereum, Solana, and Cardano also posted gains. This bullish momentum is fueled by optimism around global crypto regulation, reduced supply, and growing corporate adoption.

Bitcoin’s rally follows a record high of $112,000 last week, with analysts noting resistance at this level. The surge in inflows, bringing year-to-date totals to a record $10.8 billion, reflects strong investor confidence, particularly in Bitcoin and Ethereum exchange-traded products (ETPs). CoinShares reported that crypto ETPs’ assets under management briefly hit an all-time high of $187.5 billion, underscoring the market’s robust growth. Macroeconomic factors, such as easing geopolitical tensions and anticipated U.S. Federal Reserve interest rate decisions, are also influencing market sentiment, with lower rates typically supporting crypto prices.

Altcoins are not far behind, with Solana attracting $4.3 million and Sui $2.3 million in inflows despite a recent DeFi exploit on the latter’s network. Ethereum saw a 3.6% price increase, while Avalanche, Cardano, and Dogecoin jumped up to 5%. The market’s consolidation phase, as traders await key economic data and events like Nvidia’s earnings, suggests potential for further volatility. However, Bitcoin’s seven consecutive weekly positive closes—a rare historical pattern—hints at significant upward price movements in the coming months, according to crypto analyst Carpe Noctom.

Despite the optimism, risks remain, including potential security vulnerabilities in DeFi platforms and the impact of macroeconomic shifts. The crypto sector’s growth is tempered by ongoing regulatory uncertainties, particularly in the U.S., where clear guidelines on staking and other activities are still lacking. Nevertheless, the combination of institutional adoption and technical strength positions the market for potential new highs, with Dubai’s tokenized real estate project signaling broader real-world asset integration. Investors are advised to conduct thorough due diligence given the high-risk nature of crypto trading.

Leave a Comment

Search

Recent News

-

Chainalysis Fights AI-Driven Crypto Scams

Chainalysis Fights AI-Driven Crypto Scams

-

Microsoft Bolsters European Cybersecurity with AI

Microsoft Bolsters European Cybersecurity with AI

-

Bitcoin Faces Quantum Threat Mitigation Efforts

Bitcoin Faces Quantum Threat Mitigation Efforts

-

Crypto Market Surges with $3.3 Billion in Inflows as Bitcoin Nears $110,000

Crypto Market Surges with $3.3 Billion in Inflows as Bitcoin Nears $110,000

-

Consensus 2025 Highlights DeFi and Stablecoin Growth Amid Mainstream Adoption

Consensus 2025 Highlights DeFi and Stablecoin Growth Amid Mainstream Adoption

-

Crypto Industry Pushes for U.S. Regulatory Clarity on Staking

Crypto Industry Pushes for U.S. Regulatory Clarity on Staking

-

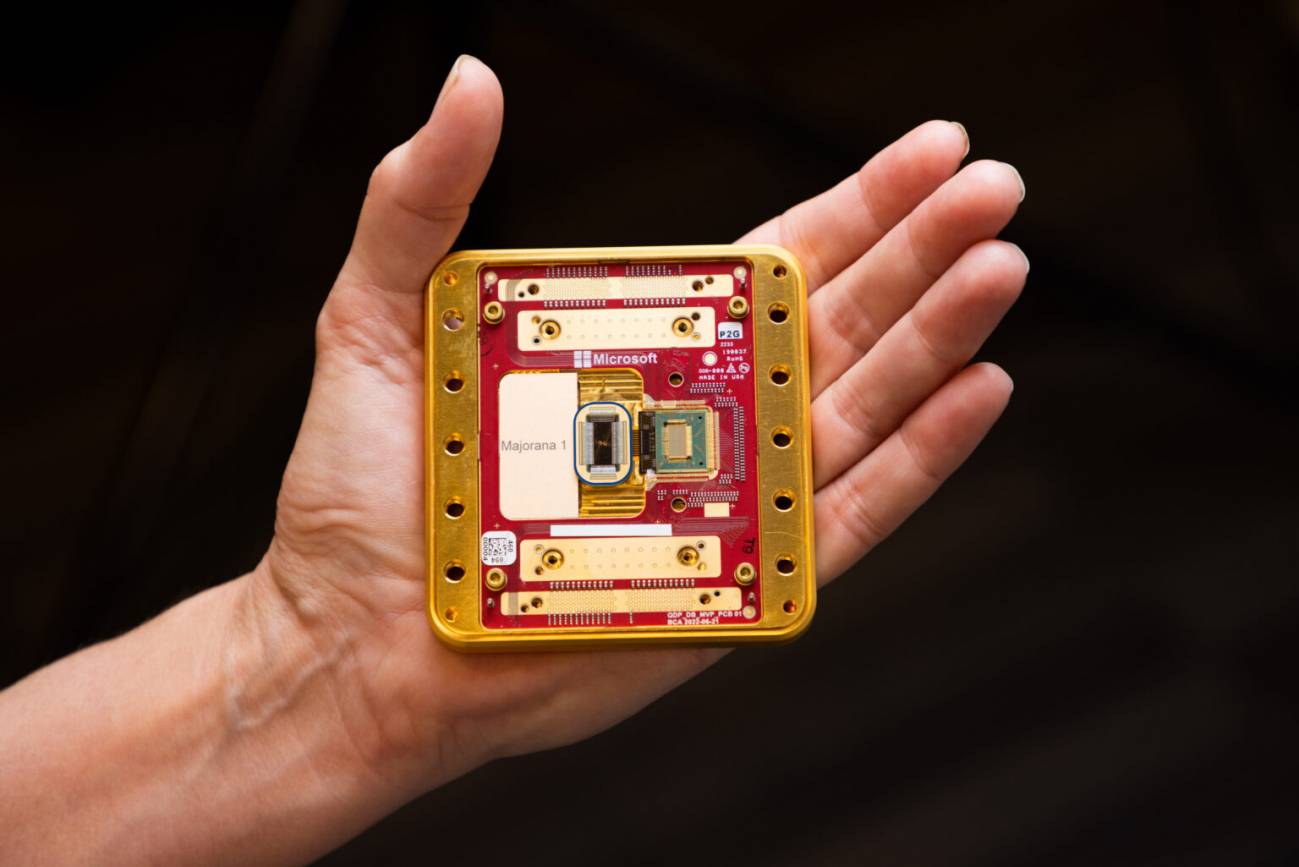

Microsoft advances in the quantum computing race with the Majorana 1 chip

Microsoft advances in the quantum computing race with the Majorana 1 chip

Visit our Youtube Videos