Categories

We build bridges for free

for the crypto community

Please support us!

Crypto

Crypto Industry Pushes for U.S. Regulatory Clarity on Staking

by admin on | 2025-05-27 04:54:52

Share: Facebook | Twitter | Whatsapp | Visits: 370

Cryptocurrency industry groups, led by the Crypto Council for Innovation, are urging the U.S. Securities and Exchange Commission (SEC) to issue formal guidance on staking, citing persistent regulatory uncertainty for Web3 infrastructure providers. Staking, a process where users lock up crypto assets to support blockchain networks and earn rewards, lacks clear SEC rules, creating challenges for businesses and investors. The call for clarity was amplified at Solana’s Accelerate conference in New York, where industry leaders emphasized staking’s importance to the crypto ecosystem.

The absence of clear staking regulations has left Web3 providers in limbo, unsure whether their activities fall under securities laws. Allison Muehr, head of staking policy at the Crypto Council for Innovation, stressed that clarifying the SEC’s stance is a top priority for the industry. This uncertainty has stifled innovation, as companies hesitate to launch or expand staking services in the U.S. Meanwhile, other jurisdictions, like Dubai, are advancing with clear frameworks for crypto activities, such as real-world asset tokenization.

The push for regulatory clarity comes as the crypto market sees increased institutional adoption, with firms like Coinbase joining the S&P 500 and major banks exploring stablecoin ventures. Clear staking rules could unlock further growth, particularly for blockchains like Ethereum and Solana, where staking is integral. However, the SEC’s cautious approach stems from concerns about investor protection and potential fraud, as seen in past exchange collapses like FTX and Mt. Gox.

The industry’s advocacy reflects a broader desire for a balanced regulatory framework that fosters innovation while addressing risks. As the U.S. navigates its role in the global crypto landscape, the outcome of these discussions could shape the competitiveness of American blockchain firms. With Trump’s administration signaling pro-crypto policies, including a potential Bitcoin reserve, 2025 may see progress toward clearer regulations, but the path forward remains uncertain.

Leave a Comment

Search

Recent News

-

Chainalysis Fights AI-Driven Crypto Scams

Chainalysis Fights AI-Driven Crypto Scams

-

Microsoft Bolsters European Cybersecurity with AI

Microsoft Bolsters European Cybersecurity with AI

-

Bitcoin Faces Quantum Threat Mitigation Efforts

Bitcoin Faces Quantum Threat Mitigation Efforts

-

Crypto Market Surges with $3.3 Billion in Inflows as Bitcoin Nears $110,000

Crypto Market Surges with $3.3 Billion in Inflows as Bitcoin Nears $110,000

-

Consensus 2025 Highlights DeFi and Stablecoin Growth Amid Mainstream Adoption

Consensus 2025 Highlights DeFi and Stablecoin Growth Amid Mainstream Adoption

-

Crypto Industry Pushes for U.S. Regulatory Clarity on Staking

Crypto Industry Pushes for U.S. Regulatory Clarity on Staking

-

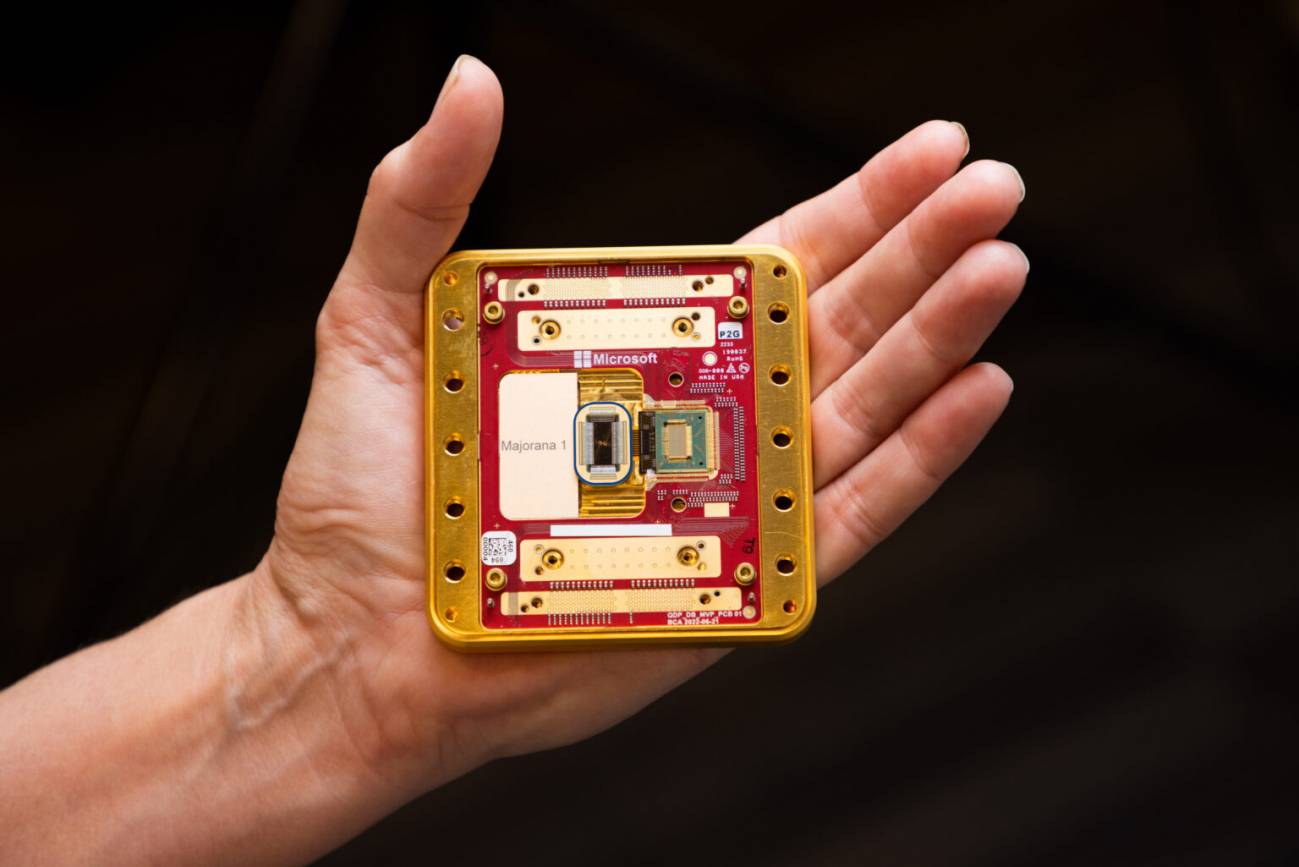

Microsoft advances in the quantum computing race with the Majorana 1 chip

Microsoft advances in the quantum computing race with the Majorana 1 chip

Visit our Youtube Videos